Understanding Carrier Air Conditioning: Insights on Share Prices and Unlisted Shares

The Indian Air Conditioning and Refrigeration (AC&R) sector is experiencing a period of significant transformation. The driving forces behind these changes include the increasing demand for better energy efficiency, rising income, the rapid adoption of smart technologies, substantial market growth, and an increasing emphasis on environmentally friendly solutions, which are benefitting manufacturers like Carrier Air Conditioning and Refrigeration. As the country’s demand for climate control systems continues to rise, both consumers and businesses are becoming more focused on how these systems are impacting the environment and how they can be improved.

The Indian AC&R market is expanding rapidly, driven by an increase in construction activities, growth in the housing sector, and rising demand from the retail and hospitality sectors. This growth is also supported by the increasing need for both residential and commercial cooling solutions. Market data suggests that air conditioner usage in India is projected to triple from 190 TWH (terawatt-hours) in 2023 to 600 TWH by 2038.

Currently, the residential sector accounts for about 70% of the market share, but the commercial sector, despite having a smaller share, tends to consume energy at a comparable rate due to longer operating hours. Additionally, the high-tech manufacturing sector, including defense, space, data centers, and electronics, is driving the need for precise air conditioning solutions to ensure operational efficiency. These factors will drive the price of the shares trading at [View Current Price of Carrier Air Conditioning] as well.

Carrier Air Conditioning Share Price: A Comprehensive Overview

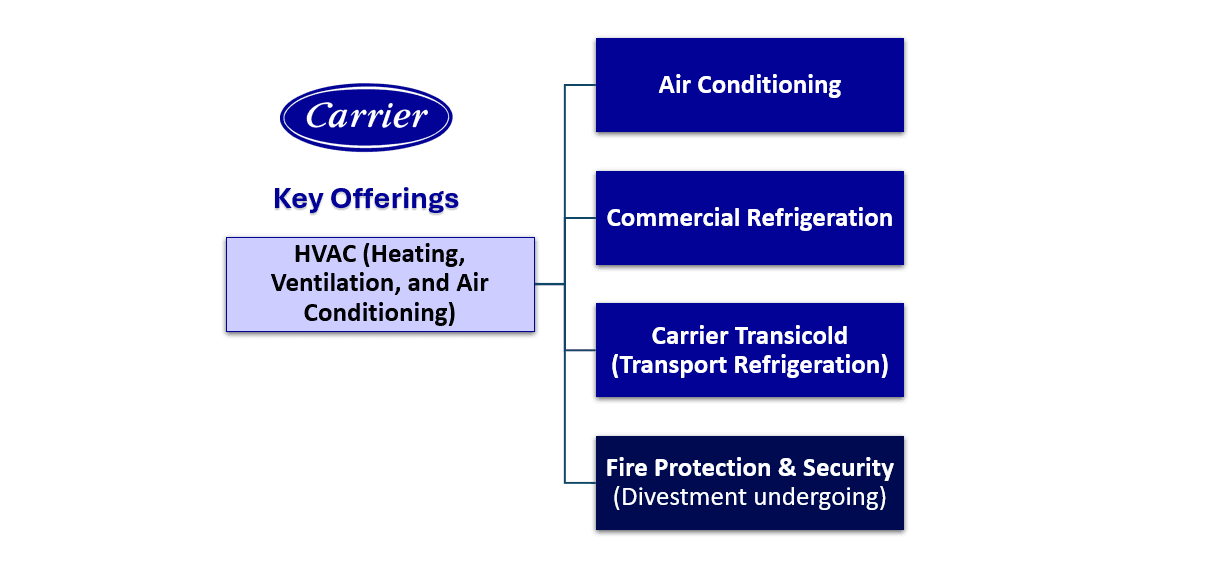

Carrier Technologies India Limited is one of the prominent players in the Indian AC&R market. They offer a wide range of air conditioning, refrigeration, and fire protection products and services. Carrier Technologies India Limited operates through several business segments, including:

1. Fire and SecurityOne of the key business segments of Carrier Technologies India Limited is Fire and Security. This division is dedicated to providing products and services designed to protect both lives and assets from potential risks like fire and security breaches. The Fire and Security segment deals with the installation, maintenance, and supply of fire protection systems, security equipment, and surveillance solutions. The systems installed by Carrier help detect smoke, fire, gas leaks, and other potential hazards, alerting users and authorities to take necessary actions.

These solutions include fire alarms, smoke detectors, and surveillance cameras. Carrier Technologies India Limited specializes in providing customized services, ensuring that the products and systems are properly integrated into each client’s specific needs.

Carrier offers turnkey services in the Fire and Security segment, meaning they handle every aspect of the project. This includes designing, installing, and maintaining the fire and security systems,making sure everything is in working order long after the installation.

2. Air Conditioning

Carrier Technologies India Limited is a major player in the air conditioning business, offering different types of cooling systems for various needs. Think of it like this: they don't just make the small window ACs you might have at home; they also do large-scale systems for big buildings and factories.

Variable Refrigerant Flow Systems: These are super-smart AC systems for large buildings. Instead of having one giant AC unit, these systems have multiple smaller units that can adjust cooling based on the needs of different rooms. Carrier is doing very well in this market, growing faster than the overall market itself.

Light Commercial Air Conditioning: These are AC units for smaller commercial spaces like offices or shops. Carrier is a strong player in this segment, meaning they're one of the top companies selling these types of ACs.

Applied Systems: This category includes larger, more complex cooling systems, mainly chillers. Chillers are like the workhorses of air conditioning for big places, using water or other liquids to cool the air like data centers, industrial cooling rooms, factories, and magnetic bearing work.

Hi-Wall Air Conditioning Units: These are the typical split AC units you see in homes and smaller offices. Carrier makes these too, including inverter models, which are more energy-efficient. Inverter technology in these models allows the compressor to adjust its speed based on the room's cooling needs. Instead of constantly turning on and off, the compressor runs more efficiently, saving energy while keeping the temperature stable.

Air Handling Units (AHUs): These are big boxes that help circulate air throughout a building. They ensure the air is clean and at the right temperature. Carrier's AHUs have Eurovent certification, which means they meet high-quality standards.

Energy Saving Solutions: Carrier also provides other important parts for refrigeration, such as compressor racks, condensers, and localized condensing units. These help make systems more efficient, which saves energy and costs.

3. Commercial Refrigeration is primarily focused on providing refrigeration solutions for the cold chain and food retail markets. The demand for refrigeration is especially high in sectors like supermarkets, restaurants, and food processing, where maintaining a constant, low temperature is crucial for preserving the quality of food. The refrigeration systems designed and provided by Carrier ensure that perishable goods remain fresh throughout their journey from producers to consumers.

Carrier offers a range of products, including compressors, condensers, and localized condensing units, which are designed to be energy-efficient and reliable. The company’s solutions cater to large-scale operations, such as cold storage warehouses and retail chains, where the need for robust refrigeration systems is critical.

In recent years, this segment has seen a growth in demand as the food retail industry continues to expand. Additionally, energy efficiency is a key focus for Carrier’s commercial refrigeration division. Their products are built with advanced features to consume less energy, helping businesses lower operational costs while maintaining high levels of performance.

However, just like with the Fire and Security division, Carrier is in the process of selling its commercial refrigeration business to Haier Appliances (India). This decision is part of Carrier’s larger strategy to simplify its operations and focus on its core business areas, such as intelligent climate solutions and energy efficiency.

4. Transicold division specializes in the transport refrigeration sector, providing innovative solutions to ensure that perishable goods are transported at safe temperatures. This is especially important for industries like logistics, where maintaining the freshness of goods during transportation is crucial. The Transicold division provides refrigeration units for trucks, trailers, and containers, making sure that items like food, pharmaceuticals, and other temperature-sensitive products are kept at optimal temperatures during transit.

One of the standout features of Carrier’s Transicold solutions is its extensive service network, with over 90 service centers located across India. This ensures that customers have access to reliable support and maintenance services, helping them keep their refrigerated transport units running smoothly.

As sustainability becomes more important, the Transicold division is also focused on providing energy-efficient solutions. The company’s transport refrigeration units are designed to consume less fuel, reducing the overall carbon footprint of the transportation industry.

Exploring Investment Opportunities: Carrier Air Conditioning Unlisted Shares Explained

Innovation and Smart Solutions: Carrier’s emphasis on smart air conditioners and energy-efficient products aligns with the sector’s push for sustainability. The introduction of AI-powered solutions and smart monitoring systems enhances user experience and reduces energy consumption.

Government Policies and PLI Scheme: The Indian government’s PLI scheme has provided a significant growth catalyst for carriers. Local production, facilitated by this policy, strengthens the company’s ability to meet the growing demand for these systems in India while offering cost-effective solutions.

Focus on Energy-Efficient Products: The increasing adoption of energy-efficient products reflects Carrier’s commitment to sustainability. These products are not only energy-efficient but also engineered for specific markets like data centers, which require precision cooling solutions.

Customer-Centric Approach: Carrier has developed specialized solutions and services tailored to the unique needs of diverse market segments. The establishment of Expert Centers and the launch of services like BluEdge for Carrier Transicold ensure customers receive top-notch support and maintenance services, increasing customer loyalty.

Divestment Strategy: Carrier has actively streamlined its business by divesting non-core segments. For example, it sold its Commercial and Residential Fire business to KEdward Technologies India Private Limited and approved the sale of its commercial refrigeration business to Haier Appliances (India) Private Limited. These strategic moves free up capital and focus resources on the company’s core strength in intelligent climate and energy solutions, thereby improving operational efficiency and long-term profitability.

What You Need to Know About Carrier Airconditioning’s Unlisted Share Price

Carrier may command only about 6% of the Indian room AC market, yet this modest share belies its strategic impact. While industry giants like Voltas, LG, and Daikin dominate overall volumes, Carrier has carved out a niche in premium and specialized segments by focusing on energy efficiency and advanced technology. This focused approach not only differentiates Carrier from its larger competitors but also drives strong customer loyalty and sets the stage for sustainable growth.

Niche Specialization with Precision Cooling:

Carrier has built a reputation for delivering high-end, energy-efficient solutions that go beyond the basics. Its focus on precision cooling—using advanced sensors and digital controls—allows the company to tailor solutions for both premium residential spaces and specialized commercial applications.

Innovative Technology Integration:

The company leverages smart technologies such as AI-powered controls and IoT connectivity to monitor and adjust performance in real-time. These innovations not only optimize energy use but also enhance user comfort and ease of control.

Local Market Adaptation:

Carrier designs its products with India’s unique challenges in mind—from high ambient temperatures and dust-prone environments to fluctuating energy costs. This localized approach ensures its systems perform reliably under Indian operating conditions.

End-to-End Service and Customization:

By offering comprehensive turnkey solutions—from design and installation to maintenance—along with a robust nationwide service network, Carrier delivers personalized support that builds lasting customer trust.

Global Expertise, Local Synergy:

Carrier’s acquisition of Toshiba in 2022 is a key strategic move that enables the company to accelerate localization. This synergy allows Carrier to blend global expertise with local market needs, driving product innovation while lowering manufacturing costs. Combining decades of international innovation with deep local insights, Carrier adapts global best practices to meet the specific needs of the Indian market, ensuring products are both world-class and regionally relevant.

Carrier’s Financial Standpoint

PROFITABILITY

Revenue Growth:Carrier’s revenue from continuing operations increased from Rs. 450.45 crores to Rs. 603.59 crores, while revenue from discontinuing operations rose from Rs. 108.36 crores to Rs. 147.12 crores. Overall, total revenue grew from Rs. 576.21 crores to Rs. 771.93 crores. This significant growth is indicative of expanding sales and a broader market presence.

Capital Utilization:Capital utilization measures how efficiently a company uses its financial resources to generate profits. Return on Equity (ROE), which shows how much profit a company generates from shareholders' investments, rose from 13% in FY 2023 to 17% in FY 2024 (a 31% increase), driven by higher sales. Return on Capital Employed (ROCE), which evaluates how well both equity and debt are used to generate earnings, increased slightly from 24% to 25%, despite a small dip in operating margin, indicating stable capital deployment.

Profit After Tax:Carrier’s profit after tax increased from Rs. 40.92 crores in 2023 to Rs. 56.38 crores in 2024. Carrier’s net profit ratio has consistently remained around 11%. This means that after all operating expenses, about 11 paise of every rupee earned is translated into profit. A stable net profit ratio signals that the company is managing its costs well, despite any market fluctuations.

Dividend Policy and Capital Reallocation:While the board did not recommend a dividend in FY2023, it declared a final dividend of Rs. 9.5 per equity share for FY2024. This approach reflects a balanced strategy: the company retains sufficient earnings to reinvest in growth while also returning value to shareholders when feasible.

ASSET MANAGEMENT

Current Ratio:The current ratio of Carrier, which measures a company’s ability to pay off its short-term liabilities with its short-term assets, declined slightly from 4.3x to 3.6x in 2024. Despite the small drop, the ratio remains healthy, suggesting that the company continues to hold ample liquid assets to cover its immediate financial obligations.

Inventory Turnover Ratio:Carrier’s inventory turnover, which indicates how quickly the company sells and replaces its inventory, improved from 3.6 to 4.3. A higher turnover means that the company is more efficient in managing its stock, reducing holding costs, and minimizing the risk of products becoming outdated.

Trade Receivables Turnover Ratio:The ratio remained relatively stable, with a slight decrease from 4.1 to 4.0, which suggests that the company is consistently managing its receivables without major delays. A stable receivables turnover means the company is reliably turning sales into cash.

Net Capital Turnover Ratio:This ratio reflects how efficiently the company uses its capital (both working capital and fixed assets) to generate revenue. This remained stable at 2.1x which indicates that Carrier is managing its resources well, ensuring that every rupee invested in capital is contributing to sales generation.

LEVERAGE

Adjusted Net Debt to Equity Ratio:Leverage is a measure of how much debt a company uses to finance its operations compared to its equity. Carrier’s adjusted net debt to equity ratio was recorded as 0.13x in 2023 and improved to 0.03x in 2024. A negligible ratio indicates that the company holds more cash and cash equivalents than its liabilities, meaning it is in a net cash position, which is a very favorable situation, as it means the company is not overly dependent on borrowed funds, which reduces financial risk and strengthens its balance sheet.

Carrier Air Conditioning shares are positioned as a key investment in India's growing AC&R market, benefiting from rising demand, technological advancements, and sustainability initiatives. While the company holds a smaller market share compared to larger competitors, its focus on energy efficiency, premium solutions, and specialized cooling technologies differentiates it. The company’s strategic divestments and financial growth indicate a clear focus on its core strengths, though challenges such as competition and evolving regulations remain. Carrier’s balanced approach to innovation, customer service, and financial management suggests steady long-term potential in the industry.