MSE Watch: The Emerging Trading Hub

The main reason stock exchanges exist is to help people and businesses use their money more effectively. Imagine you have some savings sitting in your bank account, not growing much because interest rates are low. On the other hand, some businesses need money to grow, launch new products, or expand into new markets. A stock exchange brings these two needs together.

For businesses, the stock exchange is a way to raise money. By selling shares to the public, companies can get the funds they need to grow without taking a loan from a bank. This process creates a win-win situation: you get the chance to grow your money, and companies get the resources they need to expand.

Inside MSE: Tracking Metropolitan Stock Exchange Unlisted Share Prices

Now that we understand what a stock exchange is, let’s talk about one of India’s modern stock exchanges: the Metropolitan Stock Exchange of India (MSE). It was established in 2008 to provide a fresh and technologically advanced alternative to older exchanges.

This exchange was created with a mission to make financial markets accessible to everyone. It’s not just for big companies or wealthy investors. It’s also for smaller businesses that need funds to grow and for everyday people who want to invest their money to earn more. Currently it trades at [View MSE Unlisted share price today], influenced by their mission of financial inclusion—making sure everyone can participate in the economy, no matter how much money they have to start with.

How Does MSE Work for Investors?

So, how exactly does MSE work for investors? Well, think of it as a digital marketplace for financial products. Everything happens online, so you don't need to physically visit a trading hall. With just a computer or smartphone, you can trade from anywhere in India, making investing much more accessible and efficient.

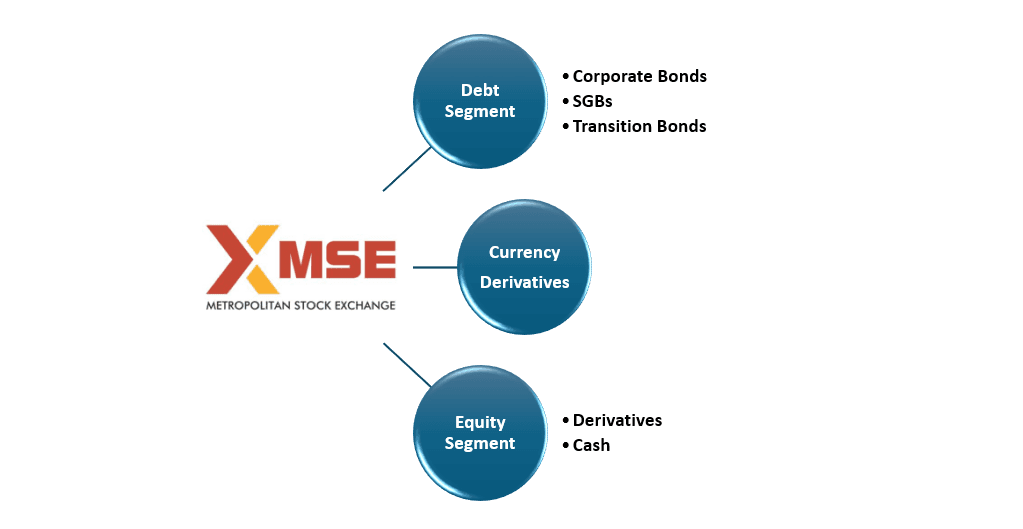

It is a marketplace where investors, businesses, and traders buy and sell different financial instruments such as shares, bonds, currencies, and derivatives. These instruments help companies raise funds, allow investors to earn returns, and help businesses manage financial risks.

Shares

When shares are purchased, they represent small ownership in a company. This money helps the company grow and fund its operations. As the company performs well, the value of shares can rise, allowing investors to sell them at a profit. However, if the company faces challenges, the value of shares may decrease.

Bonds

Bonds work like loans given to companies or the government. When an investor buys a bond, they are lending money. In return, the issuer (company or government) agrees to repay the amount with interest over time. Bonds generally provide more stable returns than shares but still have risks, especially if the issuer struggles financially.

MSE allows trading in different types of bonds, such as:

- Corporate Bonds—Issued by companies to raise money.

- Sovereign Gold Bonds—Bonds backed by the government, linked to gold prices.

- Transition Bonds—Used to fund projects that reduce pollution or support clean energy.

Currency trading (also called foreign exchange or forex trading) involves buying one currency while selling another. The value of currencies constantly changes based on economic conditions, global trade, and political events.

It allows trading in two types of currency pairs:

- Major Currency Pairs—These include the Indian Rupee (INR) against other major global currencies like USD/INR (US Dollar to Indian Rupee).

- Cross-Currency Pairs—These pairs do not involve INR. Instead, they compare two foreign currencies directly, such as EUR/USD (Euro to US Dollar).

Equity derivatives are financial contracts linked to stock or stock index prices (like Nifty 50 or Sensex). Instead of buying stocks directly, investors use these contracts to benefit from price movements without actually owning the shares.

One key feature of derivatives is the time element, as these contracts have a fixed expiry date. This means they are valid only for a specific period (such as a week, a month, or three months), after which they expire and must be settled. If an investor believes a stock’s price will increase before the contract expires, they can buy a derivative to profit from the rise. If the stock’s price moves in the opposite direction, the investor could lose money.

Since derivatives are based on future price movements and have an expiry date, timing is crucial. If the expected price movement does not happen before expiry, the contract tends to become worthless. Derivatives are high-risk due to their volatile nature, as their value is affected by multiple factors, including market sentiment, economic news, and, most importantly, time decay as loss of value happens as expiry nears.

Metropolitan Stock Exchange Share Price: Market Trends You Need to Know

- Competitive Pressures: MSE faces the ongoing challenge of competing with these dominant exchanges to attract trading volumes and listings. This competitive environment puts pressure on it to differentiate itself through innovative product offerings, competitive pricing, and advanced technology. The ability to navigate this competitive landscape and offer a compelling value proposition is crucial for its growth and survival.

- Regulatory Changes: The regulatory environment, shaped by the Securities and Exchange Board of India (SEBI), significantly impacts the operations. SEBI's directives and circulars cover a wide array of areas, including trading, risk management, and investor protection. The exchange must constantly adapt to these regulatory changes to remain compliant and competitive. For instance, the recent shifts, such as the transition to a T+1 settlement cycle, have implications for market liquidity and efficiency.

- Technological Disruption: The financial markets are undergoing advancements which calls for the need to use secure and robust technology to stay competitive which includes investing in high-speed trading infrastructure and user-friendly platforms. Technology is also key to providing seamless execution processes and enhancing customer service.

- Specific Market Segment Challenges: MSE has faced challenges in its currency derivatives segment due to regulatory changes implemented by the RBI. The circular has significantly affected currency derivative business at Indian bourses which highlights the risk of market volatility due to policy changes, as well as dependence on specific market segments.

Order Matching:

When you buy or sell, MSE matches your buying order with someone who wants to sell or your selling order with someone who wants to buy. It’s like finding the perfect match for your trade, automatically, at the right price. The exchange uses an advanced order-matching engine that works instantly, so you don’t need to wait around for your order to be filled.

Clearing and Settlement:

After the order is matched, the next step is called clearing, where it ensures both parties (the buyer and the seller) have the necessary assets or funds. For example, if you're buying shares, MSE makes sure that you have the money in your account, and the seller has the shares.

Once cleared, the settlement happens, where the shares are transferred to your demat account (which is a digital account for holding shares), and the seller receives the money in their bank account. This entire process is designed to be quick, ensuring that your transaction happens with minimal delay and maximum security.

Transaction Fees

The exchange also earns through transaction fees, which are charged for every trade you make, similar to a small fee you pay at a store. These fees help maintain the advanced technology and secure trading environment. They are typically low, and one will always know exactly how much is paid before completing a transaction.

Operational Highlights

- Uptime and Reliability: The exchange has reported 100% uptime, which ensures that users can trade without worrying about system downtime or delays, which is crucial in financial markets where timing is key.

- Customer Service Orientation: MSE focuses on quality customer service and market collaboration. The exchange works closely with market participants to understand their needs and ensure the trading platform caters to them. This customer-centric approach helps build stronger relationships with traders and investors, setting it apart from larger, more impersonal exchanges.

- Advanced Surveillance Systems: It also uses an advanced market surveillance system that can generate alerts based on user-defined thresholds. This means the exchange is constantly monitoring market activity to spot and address any irregular trading trends, ensuring the platform remains transparent and fair for all investors.

- Real-Time Data Feed in which it offers a real-time data feed service, allowing market participants to get up-to-the-minute information on prices, trends, and trading activity. This ensures that investors can make informed decisions quickly, staying ahead of market movements.

- Commitment to Regulatory Excellence: MSE takes a strong stance on regulatory compliance, positioning itself as a leader in governance practices. The exchange has segmented its regulatory functions, ensuring robust oversight in critical areas such as surveillance, listing, and investor protection. This commitment to following all guidelines laid out by the Securities and Exchange Board of India (SEBI) reflects the dedication to market integrity.

Focus on Financial Inclusion and Grassroots Reach: MSE aims to make investing accessible to everyone, especially in areas that have been underserved, like small towns and rural parts of India. By focusing on financial inclusion, it wants to bring financial knowledge and opportunities to those who haven’t had easy access to them before.

Emphasis on Innovation and Technology: The exchange is committed to using the latest technology to make its trading fast, reliable, and secure. The exchange works hard to provide a seamless experience, with quick and smooth transactions. This focus on technology helps it meet the needs of modern traders who rely on speed and accuracy. The systems are also considered highly secure, ensuring the safety of users' data and transactions.

Currency Derivatives Expertise: MSE is well-known for its expertise in currency derivatives, especially its USD/INR futures contract, which ranks among the top 10 globally traded contracts. This experience in currency trading gives it an advantage in a niche area where demand is growing.

Building Partnerships and Collaboration: The exchange works closely with other players in the financial industry, including wealth management firms, mutual funds, and brokerage houses. These partnerships help MSE address challenges and grow the market together. By collaborating with others, they are able to tap into different resources and expertise, making their platform more efficient and accessible to a wider audience.

Unique Products and Services: While the exchange is still growing, it is focused on offering unique products that meet the specific needs of investors. For example, MSE plans to launch platforms for small and medium-sized enterprises (SMEs), as well as systems for mutual funds and book-building.

Financial Highlights for MSE (2023-24)

Revenue AnalysisMSE experienced a decline in its revenue streams this year as it fell from ₹9.21 Cr in FY 2023 to ₹7.36 Cr in FY 2024, primarily due to challenges in its core operations like trading, processing, and listing activities. While transaction fees showed a modest increase, it wasn’t sufficient to offset the reduced income from other revenue areas. This reflects the competitive pressures and the need for greater participation and innovation to enhance income sources.

Profitability and Losses:Losses grew during the year from ₹19.93 Cr in FY 2023 to ₹47.60 Cr in FY 2024, a direct outcome of the sharp revenue decline. , largely as a result of reduced revenue coupled with steady operating costs. Additionally, the merger with MSE Enterprises Ltd. impacted financials due to the integration of operations. Although this pooling arrangement added to current-year losses, it represents a strategic step toward streamlining operations, which could unlock efficiencies and synergies in the future.

Segment Performance:The currency derivatives market remained a bright spot with growth in both trading volumes and turnover, showcasing its strength in this key area. Another positive development was the launch of the Capital Market segment, which became operational in FY 2023-24. Although it was introduced late in the fiscal year, this marks an important step in diversifying the offerings and further expansion.

MSE is working towards becoming a strong player in India's stock market by focusing on financial inclusion, technology, and innovation. While it faces challenges like competition, regulatory changes, and financial losses, it continues to improve its offerings, particularly in currency derivatives and capital markets. MSE’s success will depend on its ability to adapt to market trends, attract a larger investor base, and strengthen its financial position.