How HDFC Securities Share Price Is Performing: What Investors Need to Know

HDFC Securities, a flagship subsidiary of HDFC Bank, has grown into one of India’s premier stock broking entities. Since its inception in 2000, as a joint venture with Indocean eSecurities Holdings, the company has combined advanced technology with a customer-first mindset, making it a popular choice for both investors.

The company is known for its strong reputation as a full-service stock broker and investment service provider. As a subsidiary of HDFC Bank—one of India’s largest and most trusted financial institutions—the company enjoys robust financial support, an expansive customer base, and a legacy of trust. As a further glimpse is taken into its revenue offerings, the share currently trades at [View Current Market Price of HDFC Securities].

Key Revenue Offerings: HDFC Securities Unlisted Shares

Core Broking Services

Core broking services refer to the execution of trades on behalf of investors in various financial markets. A brokerage firm like HDFC Securities acts as an intermediary, ensuring that buy and sell orders are efficiently matched and executed. Investors, whether individuals or institutions, rely on these services to access markets and manage their investments seamlessly.

When an investor places an order to buy or sell a financial asset, it ensures that the transaction is executed at the best available price, adhering to market regulations and compliance norms. The brokerage firm facilitates trades through its online trading platform, mobile applications, and physical branches. It ensures that transactions are executed at competitive prices, minimizing slippage (the difference between the expected price of a trade and the actual executed price).

It offers access to a broad spectrum of financial instruments, allowing investors to build a diversified portfolio tailored to their financial objectives. The firm facilitates trading in equities, debt instruments, derivatives, mutual funds, exchange-traded funds (ETFs), commodities, currencies, and international equities. This diverse set of financial instruments ensures that investors can build a well-rounded and risk-adjusted portfolio according to their financial goals.Multi-Platform Approach and Order Placement

HDFC Securities ensures that investors of all types, whether tech-savvy traders or traditional investors, can access and execute trades seamlessly.

Online Trading Portals: Real-Time Access to Markets

It provides a robust web-based platform that allows investors to log in from any device with internet access. Through this portal, users can monitor live stock prices, track their portfolios, execute trades, and access expert research and recommendations. This ensures that investors can make informed decisions with real-time market data at their fingertips.

Mobile Applications: Trading on the Go

For mobile users, it offers two specialized apps catering to different types of investors. The HDFC SKY app is designed for active traders, featuring real-time charting, direct order placement from live charts, and in-depth market analytics. Meanwhile, the InvestRight app is tailored for general investors, integrating UPI payments for quick transactions and providing daily recommendations to help users understand market trends.

Telephone-Based Trading: Personalized Support

For those who prefer traditional methods, HDFC Securities provides a telephone-based trading service where investors can call a dedicated service center to place orders or seek assistance. This service is particularly useful for individuals who are not comfortable with digital platforms. A small fee is charged for telephone-based orders, typically ₹20 or 2.5% of the transaction value, whichever is lower.

Physical Branches: In-Person Assistance

With over 250 branches across India, it offers in-person support for investors who prefer face-to-face interactions. These branches provide personalized investment guidance, making them an excellent choice for beginners who need assistance in understanding market strategies and executing trades confidently.

By integrating digital convenience with offline support, it ensures that every investor, regardless of experience or preference, has access to an efficient and flexible trading experience.

Trade Execution and Settlement

Once an order is placed, trade execution and settlement play a crucial role in ensuring a seamless and secure transaction. It leverages advanced technology and strict regulatory compliance to facilitate quick and accurate trade execution, minimizing delays and optimizing investment outcomes.

Order Matching: Ensuring Efficient Trade Execution

When an investor places an order to buy or sell a financial asset, it uses real-time order matching technology to find a corresponding counterparty on the stock exchange. This ensures that transactions are completed efficiently and at the best possible prices. The use of artificial intelligence (AI) and machine learning further enhances this process by analyzing market conditions and ensuring optimal trade execution.

Real-Time Processing: Capitalizing on Market Movements

Speed is a key factor in trading, and it prioritizes real-time processing to help investors capitalize on price movements instantly. With market fluctuations happening within seconds, quick execution ensures that investors do not miss out on favorable price points, particularly in fast-moving stocks and derivatives.

Settlement Process: Transferring Securities and Funds

Once a trade is executed, the settlement process ensures that the transaction is completed by transferring ownership of securities and funds between the buyer and seller. HDFC Securities follows the T+1 settlement cycle, meaning that transactions are settled one business day after execution. This system enhances market liquidity and reduces transaction risks.

Transition to T+0 Settlement: The Future of Faster Transactions

India is among the first countries moving towards T+0 settlement, where trades are settled on the same day. It is actively preparing for this transition, which is expected to further boost liquidity, reduce risks, and enhance market efficiency. This shift will significantly benefit traders who rely on quick fund availability for reinvestment.

Regulatory Compliance: Ensuring Transparency and Security

Every step of the trade execution and settlement process is monitored by the Securities and Exchange Board of India (SEBI) to ensure transparency and investor protection. These regulations safeguard traders from fraud and unauthorized transactions, reinforcing trust in the system.

A simple analogy to understand this process is to think of trade execution as the moment when your buy/sell order is matched, while settlement is the final step where the ownership of shares officially transfers to you. This streamlined approach ensures a smooth trading experience, making investing more accessible and secure.

Growth Drivers of HDFC Securities

HDFC Securities’ success is driven not only by its core broking services but also by several key strategic initiatives that help it expand in the highly competitive stock broking industry. These growth drivers revolve around technological advancements, diversified investment offerings, financial inclusion, and global market expansion, positioning the company as a leader in the financial services sector.

B2B Synergies Through Technology

Technology has played a pivotal role in their growth, particularly in enhancing its partnerships and market reach. The company has implemented a fully digital onboarding process, making it easier and faster for institutional investors and business partners to register and integrate with its services. This paperless approach reduces processing time and increases efficiency.

With a strong focus on market share expansion, HDFC Securities has leveraged its advanced digital platforms to attract more institutional investors. These digital capabilities help the company establish collaborative alliances with banks, fintech firms, and other financial institutions, allowing it to diversify revenue streams beyond traditional stockbroking.

Success in Third-Party Investment Products

Beyond brokerage, HDFC Securities has strengthened its position in third-party investment products, adding multiple revenue channels:

- Mutual Funds: As one of India's top distributors, mutual fund sales contribute significantly to its earnings.

- Sovereign Gold Bonds (SGB): There has been a remarkable increase in SGB transaction volumes, reflecting investor interest in safe-haven assets.

- National Pension System (NPS): The company has built a strong subscriber base in the NPS segment, making it a dominant player in retirement planning solutions.

- Insurance Distribution: HDFC Securities is among the leading insurance distributors, further reinforcing its financial strength.

Focus on Financial Inclusion

HDFC Securities is committed to financial inclusion, ensuring that investing is accessible to all Indians. One of its key initiatives is investor education, where it offers webinars, tutorials, and learning modules to help new investors understand market trends and investment strategies.

Additionally, its platforms are equipped with innovative trading tools like real-time analytics, AI-driven personalized recommendations, and dynamic dashboards, making it easier for users to navigate the stock market. This customer-centric approach not only attracts new investors but also ensures strong customer retention and loyalty.

Global Market Expansion Through Strategic Partnerships

HDFC Securities is expanding its footprint internationally by forging alliances with global brokerage firms. These partnerships enable Indian investors to trade in international markets while also helping the company gain a share in global financial markets. Through overseas distribution channels, they are tapping into new revenue streams, reinforcing its position as a globally competitive brokerage firm.

By integrating technology, diverse investment products, financial literacy initiatives, and international collaborations, the company continues to strengthen its market leadership while offering an enhanced experience to investors at all levels.

Strategic Positioning & Market Differentiation

HDFC Securities trades at a P/E of 17.83, which is in line with the industry median of 17x, reflecting a fair valuation compared to its peers in the broking and securities industry. In terms of leverage, their Debt-to-Equity ratio of 4.70x is relatively higher than most peers. However, this reflects the company’s strategy of actively funding its ambitious growth plans, including investments in both digital innovation and physical branch expansion. Such leverage, though higher, positions them to scale efficiently while driving customer acquisition.

Democratising Investment: HDFC Securities is on a mission to support every Indian in doing smart investments. They are focused on expanding their services to underserved populations and untapped markets, driving financial inclusion and financial freedom. The company aims to empower Indians to capitalise on growth through smart investments.

Catering to the Modern Investor: The company has a specific focus on tech-savvy millennials and Gen Z investors, providing them with the tools and platforms they need for today’s markets. The HDFC SKY platform is designed to support all types of investors, regardless of their experience level. The company also offers solutions for working professionals and senior citizens through platforms like InvestRight and InvestNow, and features like Trade Smart and BSPL (Buy Stock Pay Later).

"Phygital" Approach: HDFC Securities has effectively blended a robust physical branch network with a strong digital presence. This "phygital" approach allows the company to cater to diverse customer preferences, providing both the personal touch of a traditional brokerage and the convenience of digital platforms. This strategy has helped the company achieve a large customer base with a 20% increase year-on-year.

Financial Standpoint of HDFC Securities Share: A Closer Look

Understanding the financial health of HDFC Securities is crucial for evaluating its share price performance and long-term investment potential. A detailed review of its revenue, profitability, asset quality, and leverage provides insights into the company’s growth trajectory and financial stability.

Strong Customer Acquisition

The company has a total customer base of over 5.38 million, with 1.21 million active clients. This robust base demonstrates the company's ability to attract and retain customers in a competitive market. The company has seen a growth of 40% in new investors in mutual funds, exceeding the industry average of 25%. The company achieved record SIPs and IPOs, and the margin trade facility reached ₹8,000 crore as of June 2024.

Revenue and Profitability Metrics

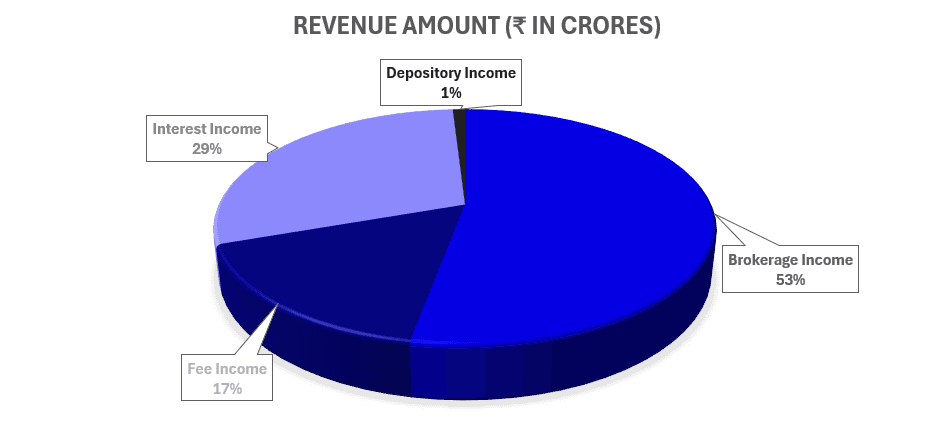

HDFC Securities has demonstrated strong revenue growth, reflecting its robust business strategy. The company’s total revenue increased from ₹1,892 crore to ₹2,661 crore, marking a 41% growth over recent years. This surge has been primarily driven by its brokerage and fee income, which remains the backbone of its operations, contributing approximately ₹1,597 crore. This growth is attributed to their robust physical and digital business models, strong branch and RM network, aggressive pricing strategies, and advanced technology platforms.

Profitability has also been on an upward trend, with profit after tax (PAT) growing from ₹384 crore in FY20 to ₹951 crore in FY24, indicating a 22% year-on-year increase. The rise in Earnings Per Share (EPS), from ₹246 in FY20 to ₹597 in FY24, further underscores the company’s ability to generate shareholder value and maintain consistent financial performance.

Asset Quality and Balance Sheet Strength

A strong balance sheet is fundamental to sustaining long-term growth. HDFC Securities reports total assets of ₹14,103 crore, alongside investments of approximately ₹1,005 crore, signifying a well-diversified portfolio. This extensive asset base reinforces the company’s operational capacity and market positioning.

On the liability side, the company has total liabilities amounting to ₹11,997 crore, which include structured debt instruments. However, its effective debt management strategy ensures that leverage remains under control, allowing for continued expansion without excessive financial strain. The company’s total equity and net worth, estimated at around ₹2,029 crore, further reflect its financial resilience.

Leverage and Key Financial Ratios

Analyzing key financial ratios provides a deeper understanding of HDFC Securities’ financial stability. The Debt-Equity Ratio stands at 4.70x, indicating a reliance on debt, which investors should monitor closely. The Current Ratio of 1.07x reflects short-term liquidity, though it is slightly lower compared to previous periods.

Dividend Policy and Capital Raising

HDFC Securities has maintained consistent dividend payouts, declaring a dividend of ₹510 per share in FY24, which rewards shareholders while signaling strong profitability. Furthermore, the company has successfully raised capital through share issuances at a premium, strengthening its capital base and providing financial flexibility for future expansion.

By focusing on strong revenue growth, asset quality, effective debt management, and shareholder returns, HDFC Securities continues to reinforce its position as a leading financial services provider.

Risk Factors

Every investment carries risks, and HDFC Securities is no exception. Understanding these risks is essential for both beginner and experienced investors to make informed decisions. The company's ability to manage these challenges plays a crucial role in ensuring financial stability and long-term sustainability.

Market Risk: HDFC Securities operates in a highly dynamic market where price fluctuations can directly impact business performance. Market volatility, driven by global economic conditions, political events, or sudden shifts in investor sentiment, can lead to sharp movements in stock prices. Additionally, interest rate risk affects profitability, as a portion of revenue comes from interest-bearing instruments. The firm also has exposure to third-party products like mutual funds and sovereign gold bonds, where revenue depends on market performance. A downturn in financial markets can reduce investor participation, affecting fee-based income.

Credit and Liquidity Risks: Credit risk arises when counterparties fail to meet their financial obligations, potentially impacting HDFC Securities' revenue. The company addresses this through an Expected Credit Loss (ECL) model, which proactively sets credit limits and closely monitors client exposures. Liquidity risk refers to the challenge of maintaining sufficient cash flow to meet obligations. To manage this, HDFC Securities ensures adequate cash reserves and access to credit facilities, reducing the likelihood of financial strain during periods of market turbulence.

Operational and Regulatory Risks: Technical failures or operational disruptions can hinder trade execution and settlement processes, impacting customer experience and business continuity. HDFC Securities mitigates this risk by making significant investments in IT infrastructure and cybersecurity, ensuring system resilience and data protection. Failure to comply with regulatory requirements could lead to penalties and reputational damage.

HDFC Securities has cemented its position as a leading stock brokerage firm in India, backed by strong technological integration, a diversified product portfolio, and the financial strength of HDFC Bank. However, challenges such as market volatility, regulatory risks, and high leverage remain factors that investors must consider. While its expansion into third-party investment products and global markets presents new growth avenues, maintaining asset quality and liquidity management will be crucial for long-term sustainability. An additional area of interest for investors is HDFC Securities' Unlisted Shares, which have attracted attention in the pre-IPO market.